Introduction

attention

The Pay Later API is only available for Payment API 1.8.

What is Pay Later?

Pay Later allows shoppers to postpone the due date of an open invoice transaction between 14 and 150 days. Shoppers may use Pay Later to prevent getting dunned. It gives them the ability to plan their payments more individually. Charges apply when using this feature.

The Pay Later API enables sellers to integrate this functionality into their frontends. The Pay Later API offers endpoints to check the Pay Later status of a purchase order and to book a Pay Later option. By using the Pay Later API shops can offer their customers greater payment flexibility when paying by open invoice while keeping them inside their own frontends.

Booked Pay Later options can be withdraw within 14 days. Therefore the shopper can use one of the channels referenced in Ratepay Pay Later Terms of Use.

How to use the Pay Later API?

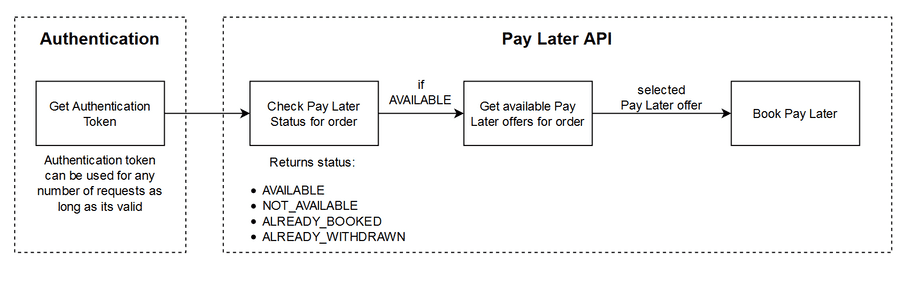

The general flow to book Pay Later is as follows:

- Get a token to access the Pay Later API (token can be used for any number of transactions as long as it is valid)

- Check if Pay Later is available for a specific transaction

- Get all available Pay Later options

- Book a specific Pay Later option

If Pay Later has been booked or withdrawn successfully, you can use the status-endpoint to get the booking details.

Each API call to the Pay Later API must contain the authentication token in the header and must use and accept JSON as content type.

The Pay Later API cannot be called through a Javascript frontend directly from a browser. The corresponding backend should call the Pay Later API instead.