Introduction

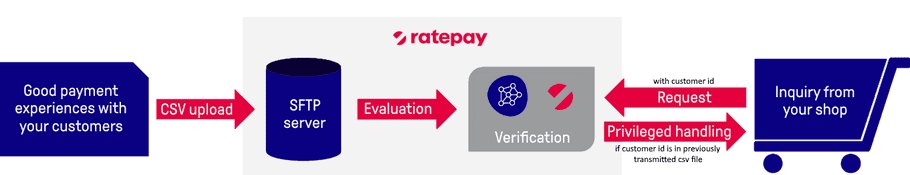

Regular customers who pay their bills on time are an important asset for every merchant. We give you the opportunity to use this capital within Ratepay's risk assessment by sharing the payment history to improve the acceptance rate.

From Ratepay's point of view, a regular customer is a buyer who has had positive payment characteristics at the merchant's shop within the last 24 months.

attention

Legal notice: According to applicable data protection laws, the implementation of the Ratepay regular customer concept requires the conclusion of a Data Processing Agreement in accordance with Art. 28 GDPR ("DPA") between the Merchant and Ratepay. The DPA is concluded between the Merchant and Ratepay via the Merchant Agreement or a respective Supplementary Agreement to the Merchant Agreement.

Data Processing Agreement for Regular Customer Concept for Merchants

Requirements

- Each regular customer must have a unique customer identifier, e. g. customer number

- SFTP server connection (see also Secure data exchange via Ratepay )

Procedure

- Ratepay provides you access to the Ratepay SFTP server , where you can upload the payment histories of your regular customers. Please submit a SSH key before according to Secure data exchange via Ratepay .

- The merchant creates a payment history of their customers in a certain time interval as csv file for the last 24 months, according to the Technical description . Additonally, a .md5 Checksum file must be created for the corresponding regular customer files.

- Upload the newly created files to the SFTP server, according to Data transfer .

-

After the regular customer places a new order with the merchant's shop, this customer is now

given priority in our risk assessment

. The requirement is, that the unique

customer identifier

is also included in the

PAYMENT

_

REQUEST (Payment API 1.8; as parameter

merchant-consumer-id)or Authorize call (Payment API 2.0; as parametershop_buyer_id)

Evaluation by Ratepay

Ratepay's regular customer evaluation is based on the amount and frequency of orders minus cancellations and returns as well as punctuality of payments.

Examples

| Case | Effect |

|---|---|

| Customer orders per month on average for 50 Euro and pays punctually | Customer is rated as good and receives clear advantages in risk assessment |

| Customer orders a single time for 50 Euro and pays punctually | Customer is rated a little more benevolently than unknown customers |

| Customer orders only once for 100 Euros, pays punctually, but returns the entire delivery | No regular customer evaluation |

Consideration in the risk process

When placing an purchase order you need to send us the same identifier you used in this list. If there is a positive customer rating, this is taken into account during Ratepay's risk process.

- Customers get higher limits (The total amount allowed for outstanding invoices increases)

- Request is accepted although the result of the risk assessment would otherwise have led to a rejection

This results in a higher acceptance rate and thus to higher sales overall.